The regulator opted for relatively loose rules to help nurture the industry, mostly populated by start-ups. Japan last year rolled out the world's first system to oversee cryptocurrency exchanges, in a bid to protect customers and stamp out illegal uses of cryptocurrencies as it sought to nurture a young and promising sector. The body will set out rules on issues like exchange security and advertising, and will lay out penalties for members who don't follow the policies, the Nikkei business daily reported on Wednesday. They had originally planned to merge two existing industry bodies representing both registered and unregistered exchanges. as trading in JPY/BTC for the period of this. The registered exchanges will form a self-regulatory body from April, sources have told Reuters. Only five Bitcoin exchanges, BitFlyer, BTCBOX, Coincheck, Kraken and Zaif, are listed on. The entire stolen loot has an estimated worth of 60 million USD. MONA coin and Bitcoin Cash were also stolen. The heist resulted in the loss of close to 6,000 Bitcoin (BTC).

Coincheck zaif full#

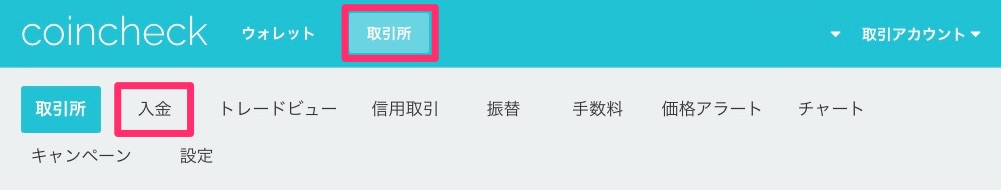

Zaif is one of 16 exchanges registered with the government, which last year allowed a further 16 - including Coincheck - to continue operating pending full registration. Japans Zaif Exchange Hack The cryptocurrency market took another hit last night when the Zaif exchange hack was announced. The theft also drew into question Japan's system of overseeing exchanges. The latest flub could draw further attention to security and systems at cryptocurrency exchanges, which were already under scrutiny in the wake of the Coincheck heist. Zaif's operator had already faced checks after last month's theft of $530 million in digital money from Coincheck Inc, with regulators fearing its systems were at risk from cyber-attacks. The exchange voided the trades after discovering the error, which happened on February 16 - though it was still trying to resolve the issue with one customer who tried to transfer the knock-down bitcoins from the exchange, a spokesman told Reuters. Zaif, a government-registered exchange run by Osaka-based Tech Bureau Corp, said on Tuesday that a system glitch had let seven customers buy bitcoin with no yen value during a 20-minute window last week.

Coincheck zaif for free#

Ledger hardware wallets offer the best path forward for investors to safeguard their crypto assets and protect against attacks.A blunder at a Japanese cryptocurrency exchange let investors briefly buy bitcoins for free - though none were able to profit from the mistake. To combat them, crypto asset owners need the most sophisticated security technology available. Ledger has developed hardware wallet technology offering state-of-the-art levels of security for the private keys providing access to your crypto assets through a secure element – a chip designed specifically to resist highly skilled attackers and used notably in passports and credit cards, and a proprietary OS (Operating System) designed specifically to protect crypto assets.īreaches such as this Zaif incident are complex and involve the smartest hackers in the world.

Luckily, solutions exist to keep your private keys secure, such as hardware wallets. While exchanges are tightening security measures, hackers are becoming more sophisticated every day, leaving investors responsible to take security into their own hands. When they leave the private keys providing access to their assets on an exchange platform, crypto investors are essentially entrusting a third party – the exchange – to enforce security measures to keep private keys safe against hackers.Īnd while some exchanges provide a basic level of security, many aren’t equipped to prevent malicious breaches and safeguard investors’ private keys to the extent of a security company. Essentially, they are online platforms serving as digital marketplaces where crypto traders can buy and sell cryptocurrencies. Gox, Bitfinex and Bitstamp, are not security companies. Theft of crypto assets, whether minor or extraordinarily detrimental, blatantly shows the vulnerabilities of crypto exchanges and points to the larger issue of the security or lack thereof protecting exchanges.Įxchange platforms, such as Mt. The incident, which occurred last week, is the latest in a string of breaches occurring in Asia this year and comes less than eight months after the Coincheck hack. Yesterday it was reported that Zaif, a major Japanese cryptocurrency exchange, was hacked, resulting in a loss of 6.7 billion yen, including 5,966 bitcoins (about $60 million).

0 kommentar(er)

0 kommentar(er)